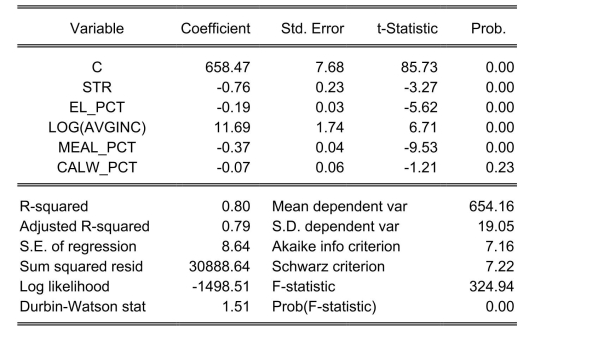

Consider the following regression output for an unrestricted and a restricted model. Unrestricted model:

Dependent Variable: TESTSCR

Method: Least Squares

Date: 07/31/06 Time: 17:35

Sample: 1420

Included observations: 420

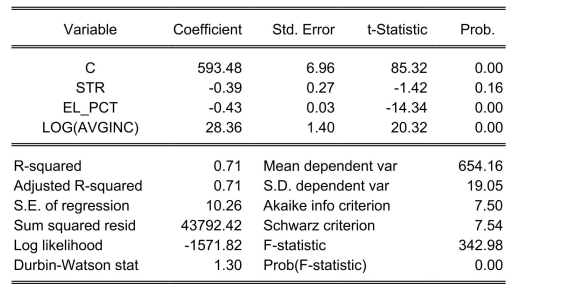

Restricted model:

Dependent Variable: TESTSCR

Method: Least Squares

Date: 07/31/06 Time: 17:37

Sample: 1420

Included observations: 420

Calculate the homoskedasticity only F-statistic and determine whether the null hypothesis

can be rejected at the 5% significance level.

Definitions:

Year 2

The second year in a sequence, often used in financial and operational planning or analysis.

Debt-to-Equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by shareholders' equity; it indicates the proportion of equity and debt the company is using to finance its assets.

Year 2

A reference to the second year in a given context, typically used in financial forecasting or product development timelines.

Return On Total Assets

A financial metric that measures a company's earnings before interest and taxes (EBIT) relative to its total asset value.

Q9: (Requires Appendix material) The long-run, stationary

Q24: In a certain town, 10% of people

Q28: The following linear hypothesis can be

Q33: <span class="ql-formula" data-value="\text { Consider the AR(1)

Q33: <span class="ql-formula" data-value="\hat { \beta } -

Q35: Negative autocorrelation in the change of a

Q35: The probability of an outcome<br>A)is the number

Q35: When you have an omitted variable

Q40: The homoskedasticity only F-statistic is given

Q46: Assume that Y is