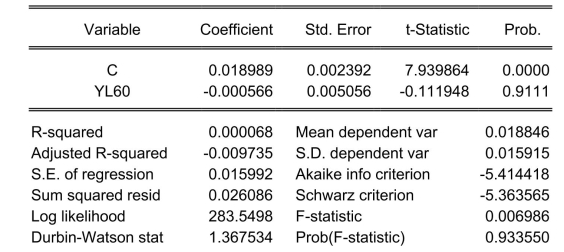

The neoclassical growth model predicts that for identical savings rates and population growth rates, countries should converge to the per capita income level. This is referred to as the convergence hypothesis. One way to test for the presence of convergence is to compare the growth rates over time to the initial starting level, i.e., to run the regression , where is the average annual growth rate of GDP per worker for the 1960-1990 sample period, and is GDP per worker relative to the United States in 1960. Under the null hypothesis of no convergence, , implying ("beta") convergence. Using a standard regression package, you get the following output: Dependent Variable: G6090

Method: Least Squares

Date: 07/11/06 Time: 05:46

Sample: 1104

Included observations: 104

White Heteroskedasticity-Consistent Standard Errors & Covariance

You are delighted to see that this program has already calculated p-values for you.

However, a peer of yours points out that the correct p-value should be 0.4562.

Who is right?

Definitions:

Empathy

The capacity to understand or feel what another person is experiencing from within their frame of reference.

Prosocial Behavior

Voluntary actions intended to benefit or help others, such as sharing, comforting, or rescuing.

Sympathy

Feelings of pity or sorrow for someone else's misfortune.

Temperament

Refers to the innate aspects of an individual's personality, such as their tendency towards certain moods or behaviors.

Q2: <span class="ql-formula" data-value="\mathrm { E } \left(

Q4: Discuss the properties of the OLS estimator

Q5: The neoclassical growth model predicts that for

Q11: Besides maximum likelihood estimation of the logit

Q23: Let there be q

Q24: When the sample size n

Q29: The slope estimator, <span class="ql-formula"

Q36: Describe the process for making a tree

Q38: The following data show the number

Q59: Determine whether the given value is a