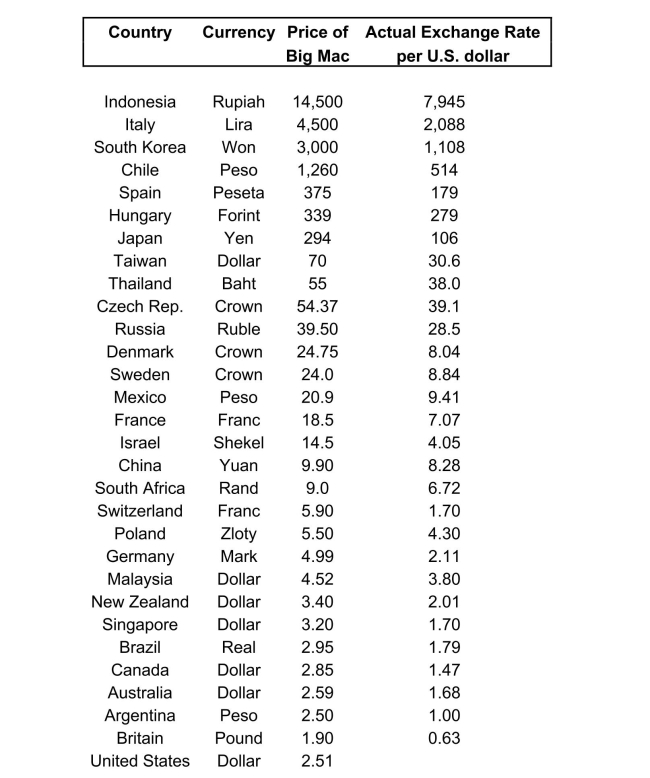

The news-magazine The Economist regularly publishes data on the so called Big Mac

index and exchange rates between countries.The data for 30 countries from the April 29,

2000 issue is listed below:  The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. a)Enter the data into your regression analysis program (EViews, Stata, Excel, SAS, etc.).

The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. a)Enter the data into your regression analysis program (EViews, Stata, Excel, SAS, etc.).

Calculate the predicted exchange rate per U.S.dollar by dividing the price of a Big Mac

in local currency by the U.S.price of a Big Mac ($2.51).

Definitions:

Fixed Amounts

Predetermined quantities or sums that do not change over time or in response to varying conditions.

Trade by Bartering

A method of exchanging goods or services directly without using money.

Laissez-Faire

Laissez-faire is an economic philosophy advocating for minimal government intervention in the market, with transactions between private parties being free from tariffs, subsidies, and enforced monopolies.

Government Interference

Actions by the government that affect the market, often with the intention of correcting market failures or achieving a social objective.

Q1: Form a conclusion about statistical significance. Do

Q11: If you wanted to test, using

Q20: The local Tupperware dealers earned these

Q26: The errors-in-variables model analyzed in the

Q29: (Requires Appendix material) When the fifth

Q33: Correlation of the regression error across observations<br>A)results

Q37: The sample regression line estimated by OLS<br>A)has

Q47: The accompanying table lists the height

Q51: Find the standard deviation for the

Q54: Under imperfect multicollinearity<br>A)the OLS estimator cannot be