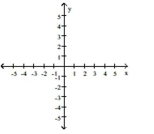

Graph the function.

-

Definitions:

Adequate Clothing

Apparel that sufficiently meets the requirements for weather conditions, social norms, and functionality.

Self-transcendence

A psychological state characterized by the expansion of self-boundaries, involving the experience of going beyond the personal self into broader aspects of human experience.

Self-actualization

A process of fulfilling one's potential and achieving the highest level of human functioning.

Belongingness Needs

A basic human drive to create and sustain robust, enduring connections with others.

Q5: <span class="ql-formula" data-value="x ^ { 4 }

Q56: A computer is purchased for $4100.

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) -2,3

Q66: <span class="ql-formula" data-value="32 ^ { \circ }"><span

Q87: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6590/.jpg" alt=" A)

Q127: Tasha borrowed $13,000 to purchase a new

Q132: log (0.001) <br>A) <span class="ql-formula"

Q187: A company manufactures three types of cable.

Q192: <span class="ql-formula" data-value="S ( x ) =

Q211: <span class="ql-formula" data-value="x ^ { 3 }