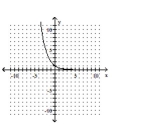

Determine whether or not the function is one-to-one.

-

Definitions:

Fine Motor Skills

The abilities that involve the use of small muscles in the hands and fingers for precise movements, such as writing or buttoning.

Precise

Marked by exactness and accuracy of expression or detail.

Respect

The admiration or deference shown towards something or someone considered important, valuable, or authoritative.

Sports Fun

The joy and enjoyment derived from engaging in physical activities and games.

Q10: Consider the logistic function <span

Q17: A pediatric speech therapist started her

Q48: <span class="ql-formula" data-value="6 n ^ { 2

Q69: <span class="ql-formula" data-value="\ln \mathrm { e }

Q71: <span class="ql-formula" data-value="\log _ { x }

Q96: <span class="ql-formula" data-value="f ( x ) =

Q97: A rule for estimating the number

Q186: The manager of big box store

Q206: \[\begin{array}{l}<br>\text { What is the } y

Q258: <span class="ql-formula" data-value="f ( x ) =