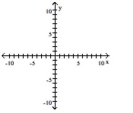

Graph the hyperbola.

-

Definitions:

Taxable Income

The amount of an individual's or entity's income used as the basis for calculating how much tax they owe to the government, after deductions and exemptions.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Total Tax Rate

The comprehensive rate at which income is taxed, combining the effects of both federal and state rates, and possibly other levies.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Q10: <span class="ql-formula" data-value="\frac { ( y +

Q17: Use inductive reasoning to find a pattern,

Q26: When two dice are tossed, find the

Q37: Use a preference table for the

Q59: If <span class="ql-formula" data-value="\mathbf {

Q59: In hyperbolic geometry, how many lines can

Q83: Which of the following is not

Q85: <span class="ql-formula" data-value="x ^ { 2 }

Q105: <span class="ql-formula" data-value="x=2 \tan t, y=4 \sec

Q251: <span class="ql-formula" data-value="\cos ^ { - 1