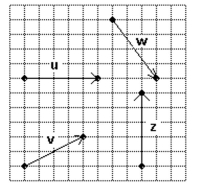

Use the vectors in the figure below to graph the following vector.

-

Definitions:

Segmentation Strategy

Segmentation Strategy involves dividing a broad market into distinct subgroups of consumers with common needs or characteristics, to target them more effectively.

Butterball Turkeys

A brand known for its turkey products, including whole turkeys and turkey meats, popular in the United States especially during festive seasons.

Swift Meat Company

A historic American corporation involved in the meat packing industry, now part of JBS S.A.

Market Segment

A subgroup of individuals or organizations sharing one or more characteristics that cause them to have similar product or service needs.

Q12: <span class="ql-formula" data-value="\left( - 3 , -

Q18: <span class="ql-formula" data-value="\mathrm { a } =

Q20: Estimate the total cost of the

Q26: <span class="ql-formula" data-value="f ( x ) =

Q29: Find <span class="ql-formula" data-value="\cos \mathrm

Q51: How many different ways can 3 winning

Q89: In triangle <span class="ql-formula" data-value="A

Q169: <span class="ql-formula" data-value="x = 7 \sin t

Q189: <span class="ql-formula" data-value="\left(2,-\frac{\pi}{4}\right)"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mo fence="true">(</mo><mn>2</mn><mo

Q281: <span class="ql-formula" data-value="\cos \left( \sin ^ {