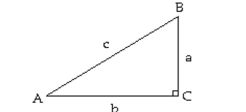

Solve the right triangle shown in the figure. Round lengths to one decimal place and express angles to the nearest

tenth of a degree.

-

Definitions:

Market Risk Premium

The extra return that investors require for choosing to invest in the general market rather than risk-free investments.

Beta

A measure of a stock's volatility in relation to the overall market; it indicates the stock's sensitivity to market movements.

Dividend Growth Model

A valuation method used to estimate the value of a stock by using predicted dividends and discounting them back to present value.

Risk Level

A measurement or assessment of the degree of uncertainty regarding the outcome of an investment or decision.

Q54: <span class="ql-formula" data-value="\sin 4 t = 2

Q73: <span class="ql-formula" data-value="f ( x ) =

Q90: <span class="ql-formula" data-value="\log _ { 3 }

Q113: Period of <span class="ql-formula" data-value="y

Q117: <span class="ql-formula" data-value="7 x ^ { 4

Q145: <span class="ql-formula" data-value="\sin ^ { 2 }

Q239: <span class="ql-formula" data-value="\log _ { 5 }

Q323: <span class="ql-formula" data-value="y = - 3 \cos

Q373: <span class="ql-formula" data-value="\sin \left( - \frac {

Q507: <span class="ql-formula" data-value="f(x)=10+7 x+x^{2}"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mi>f</mi><mo