SCENARIO 17-11

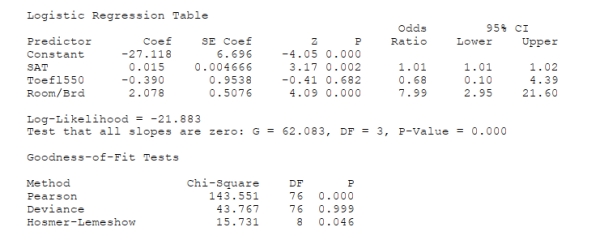

A logistic regression model was estimated in order to predict the probability that a randomly chosen

university or college would be a private university using information on mean total Scholastic

Aptitude Test score (SAT) at the university or college, the room and board expense measured in

thousands of dollars (Room/Brd), and whether the TOEFL criterion is at least 550 (Toefl550 = 1 if

yes, 0 otherwise.) The dependent variable, Y, is school type (Type = 1 if private and 0 otherwise).

The Minitab output is given below:

-Referring to Scenario 17-11, what is the p-value of the test statistic when testing whether SAT

makes a significant contribution to the model in the presence of the other independent variables?

Definitions:

Secured Debt

A debt that is backed by collateral, providing the lender with assurance that the loan can be recovered if defaulted.

Unsecured Debt

A type of debt that is not backed by collateral, making it riskier for lenders and often resulting in higher interest rates for borrowers.

Reinvestment Rate Risk

The risk that the yield from reinvesting cash flows will be lower than the initial investment's yield, typical in fixed-income securities.

Zero Coupon Bonds

Bonds that do not pay periodic interest payments and are instead sold at a discount from their face value and redeemed at maturity for the full face value.

Q29: A high value of R2 significantly above

Q49: A least squares linear trend line is

Q50: Referring to Scenario 18-4, what percentage of

Q76: Referring to Scenario 17-13, the sparklines enable

Q86: Referring to Scenario 15-6, the model

Q89: Poke-Yoke devices establish ways to clean and

Q107: Referring to Scenario 16-15-A, you can conclude

Q131: Splitting is always followed by pruning in

Q220: Referring to Scenario 16-15-B, what is the

Q267: Referring to Scenario 14-3, what is the