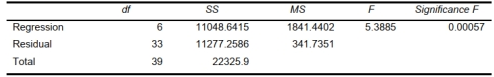

SCENARIO 17-10 Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age of the worker (Age), the number of years of education received (Edu), the number of years at the previous job (Job Yr), a dummy variable for marital status (Married: married, otherwise), a dummy variable for head of household (Head: yes, no) and a dummy variable for management position (Manager: yes, no). We shall call this Model 1. The coefficient of partial determination ( (All raiables excopt ) ) of each of the 6 predictors are, respectively, , , and .

-Referring to Scenario 17-10 and using both Model 1 and Model 2, there is

sufficient evidence to conclude that the independent variables that are not significant individually

are also not significant as a group in explaining the variation in the dependent variable at a 5%

level of significance?

Definitions:

Residual Dividend Model

A strategy for determining dividend payments based on the residual or leftover earnings after all operational and expansion costs have been met.

Clientele Effect

A theory suggesting that changes in dividend policy will attract different types of investors based on their personal preferences for dividend payouts.

Stock Repurchases

This is a process where a company buys back its own shares from the marketplace, potentially reducing the total number of outstanding shares and often seen as a way to return value to shareholders.

Capital Gains Taxes

Taxes on the profit made from selling an asset for more than its purchase price.

Q2: Referring to Scenario 16-15-B, construct a scatter

Q30: Referring to Scenario 16-15-A, what is your

Q44: Common causes of variation are correctable without

Q67: Referring to Scenario 19-6, the optimal strategy

Q96: Referring to Scenario 18-7, construct an

Q117: In multiple regression, the _ procedure permits

Q155: Quick Changeover Techniques is among the tools

Q173: Referring to Scenario 16-13, what is the

Q372: The weight of a randomly selected cookie

Q378: Referring to Scenario 17-10 Model 1, what