SCENARIO 14-15

The superintendent of a school district wanted to predict the percentage of students passing a sixth-

grade proficiency test. She obtained the data on percentage of students passing the proficiency test

(% Passing), mean teacher salary in thousands of dollars (Salaries), and instructional spending per

pupil in thousands of dollars (Spending) of 47 schools in the state. Following is the multiple regression output with Passing as the dependent variable,

Salaries and Spending:

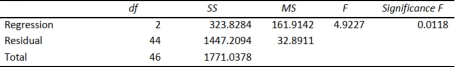

ANOVA

-Referring to Scenario 14-15, what is the value of the test statistic when testing whether

instructional spending per pupil has any effect on percentage of students passing the proficiency

test, taking into account the effect of mean teacher salary?

Definitions:

Strike Price

The specified price at which the holder of an option can buy (call option) or sell (put option) the underlying asset or security until the expiration date.

Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specific time period.

Stock Price

The current market price at which a share of a company's stock can be bought or sold.

Volatile

Describes an asset, security, or market characterized by rapid and significant price changes over a short period.

Q15: Referring to Scenario 15-7-A, the p value

Q17: Referring to Scenario 16-13, what is

Q61: Referring to Scenario 14-20-B, which of

Q73: In data mining where huge data sets

Q85: Referring to Scenario 13-13, the p-value of

Q96: Referring to Scenario 14-20-B, what is

Q112: Referring to Scenario 14-17, the alternative

Q119: Referring to Scenario 16-8, the fitted value

Q136: Referring to Scenario 13-4, the managers of

Q192: Referring to Scenario 13-10, the mean weekly