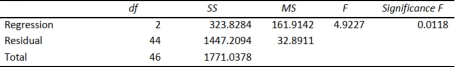

SCENARIO 14-15

The superintendent of a school district wanted to predict the percentage of students passing a sixth-

grade proficiency test. She obtained the data on percentage of students passing the proficiency test

(% Passing), mean teacher salary in thousands of dollars (Salaries), and instructional spending per

pupil in thousands of dollars (Spending) of 47 schools in the state. Following is the multiple regression output with Passing as the dependent variable,

Salaries and Spending:

ANOVA

-Referring to Scenario 14-15, you can conclude definitively that mean teacher

salary individually has no impact on the mean percentage of students passing the proficiency test,

taking into account the effect of that instructional spending per pupil, at a 10% level of

significance based solely on but not actually computing the 90% confidence interval estimate for .

Definitions:

Acquisition

The act of acquiring control of another company or business unit by purchasing its shares or assets.

Consolidated Additional Paid-in Capital

The excess amount investors pay over the par value of shares, aggregated from all subsidiaries of a parent company and reported on the consolidated financial statements.

Additional Paid-in Capital

The amount of money investors have paid for shares above their nominal value during the issuance of stock.

Voting Shares

Shares of a company that grant the shareholder the right to vote on company matters, such as electing the board of directors.

Q3: Referring to Scenario 14-17, you can conclude

Q20: Referring to Scenario 12-5, the expected cell

Q60: Referring to Scenario 12-6, what is the

Q89: Referring to Scenario 16-13, what is

Q118: Consider a regression in which

Q122: A multiple regression is called "multiple" because

Q162: Referring to Scenario 13-14-B, the p-value of

Q191: If a categorical independent variable contains 4

Q222: Referring to Scenario 13-14-A, the conclusion on

Q255: Referring to Scenario 14-17, there is sufficient