SCENARIO 14-17

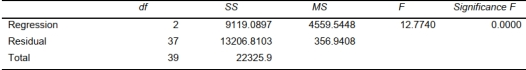

Given below are results from the regression analysis where the dependent variable is the number of

weeks a worker is unemployed due to a layoff (Unemploy) and the independent variables are the age

of the worker (Age) and a dummy variable for management position (Manager: 1 = yes, 0 = no).

The results of the regression analysis are given below:

-Referring to Scenario 14-17, which of the following is the correct null hypothesis to test whether age has any effect on the number of weeks a worker is unemployed due to a layoff while

Holding constant the effect of the other independent variable? a)

b)

c)

d)

Definitions:

Term Structure

The relationship between interest rates (or bond yields) and different terms (or maturities), typically depicted in a yield curve.

Expectations Theory

A theory suggesting that long-term interest rates reflect the market's expectation for future short-term rates.

Liquidity Preference Theory

Theory that investors demand a risk premium on long-term bonds. Implies that the forward rate generally will exceed the expected future interest rate.

Treasury Bond

A Treasury bond is a long-term, fixed-interest government debt security with a maturity of 20 to 30 years and pays interest every six months.

Q28: Referring to Scenario 14-19, what are the

Q98: Referring to Scenario 14-19, what should be

Q104: If the plot of the residuals is

Q110: Referring to Scenario 12-6, the null hypothesis

Q115: Referring to Scenario 13-10, what is the

Q161: You give a pre-employment examination to your

Q172: Referring to Scenario 16-13, the best model

Q186: Referring to Scenario 12-5, there is sufficient

Q187: Referring to Scenario 12-1, if the

Q235: Referring to Scenario 13-4, set up a