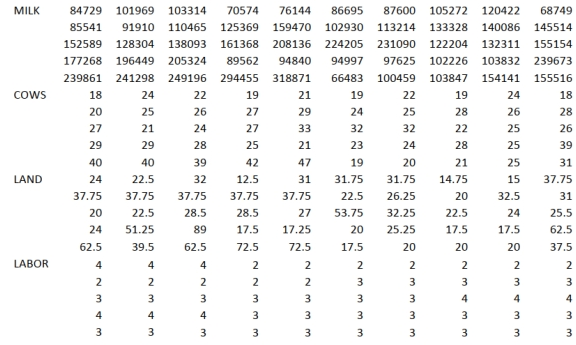

SCENARIO 14-20-A

You are the CEO of a dairy company. You are planning to expand milk production by purchasing

additional cows, lands and hiring more workers. From the existing 50 farms owned by the company,

you have collected data on total milk production (in liters), the number of milking cows, land size (in

acres) and the number of laborers. The data are shown below and also available in the Excel file

Scenario14-20-DataA.XLSX.

S

You believe that the number of milking cows , land size and the number of laborers are the best predictors for total milk production on any given farm.

-Referring to Scenario 14-20-A, construct the residual plot for the number of laborers.

Definitions:

Managed Portfolio

An investment portfolio that's actively managed by a professional, aiming to achieve specified investment goals.

Alpha

A metric used to measure the performance of an investment relative to a benchmark, reflecting the excess return of the investment compared to the overall market performance.

Time-Weighted Return

A method of calculating investment returns that eliminates the effects of cash flows into and out of the portfolio, focusing solely on the investment's performance.

Q59: When would you use the Tukey-Kramer procedure?<br>A)

Q70: Referring to Scenario 13-14-B, the degrees of

Q113: Referring to Scenario 15-2, is the overall

Q135: Referring to Scenario 14-9, the value

Q136: Referring to Scenario 13-4, the managers of

Q167: Referring to Scenario 12-17, what is the

Q179: In testing for differences between the

Q180: The chi-square test of independence requires that

Q228: Referring to Scenario 14-15, there is sufficient

Q266: A regression had the following results: SST