SCENARIO 11-2

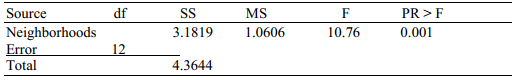

A realtor wants to compare the mean sales-to-appraisal ratios of residential properties sold in four neighborhoods (A,B,C,and D) .Four properties are randomly selected from each neighborhood and the ratios recorded for each,as shown below.

A: 1.2,1.1,0.9,0.4

C: 1.0,1.5,1.1,1.3

B: 2.5,2.1,1.9,1.6

D: 0.8,1.3,1.1,0.7

Interpret the results of the analysis summarized in the following table:

-Referring to Scenario 11-2,

Definitions:

Treynor Measure

A performance metric that measures the returns earned in excess of that which could have been earned on a riskless investment per each unit of market risk.

Standard Deviation

A measure of the dispersion or variability in a set of values, used to assess the risk associated with a particular security or investment portfolio.

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates the stock is more volatile than the market, while a beta below 1 indicates the stock is less volatile.

Nonlinear Factor Exposures

Nonlinear Factor Exposures refer to investment sensitivities to market factors that do not change in a straight-line (linear) relationship with the market's movements.

Q24: Referring to Scenario 12-6, there is sufficient

Q48: For a given level of significance, if

Q92: Referring to Scenario 11-4, the null hypothesis

Q116: Referring to Scenario 13-4, the least squares

Q127: Referring to Scenario 13-8, the value of

Q135: Referring to Scenario 10-3, suppose

Q171: Referring to Scenario 10-16-B, what is the

Q183: A Marine drill instructor recorded the time

Q210: Referring to Scenario 13-9, to test the

Q226: Referring to Scenario 10-6, what is the