SCENARIO 11-12

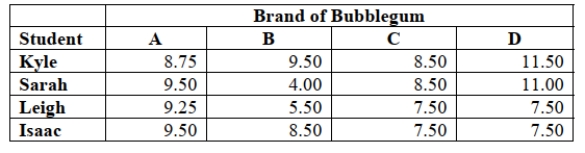

A student team in a business statistics course designed an experiment to investigate whether the brand

of bubblegum used affected the size of bubbles they could blow. To reduce the person-to-person

variability, the students decided to use a randomized block design using themselves as blocks.

Four brands of bubblegum were tested. A student chewed two pieces of a brand of gum and then blew

a bubble, attempting to make it as big as possible. Another student measured the diameter of the

bubble at its biggest point. The following table gives the diameters of the bubbles (in inches) for the

16 observations.

-Referring to Scenario 11-12, the randomized block F test is valid only if the

population of diameters is normally distributed for the 4 brands.

Definitions:

Expectations

Beliefs about the way events or actions will unfold based on previous experiences or societal standards.

Performance

The manner in which an individual or group executes or accomplishes a task, job, or function measured against preset known standards.

Attribution Management

A technique in marketing focused on identifying and assigning value to various marketing efforts to understand their contribution to a goal, such as sales or conversions.

Self-Promotion

A strategy individuals employ to present themselves to others in a favorable light by highlighting their strengths and accomplishments.

Q10: The contingency table below shows the

Q28: In a study comparing the effects

Q56: A business professor conducted a campus survey

Q61: A realtor collected the following data

Q105: To construct a bootstrap confidence interval estimate

Q112: Sampling error can be completely eliminated by

Q177: Referring to Scenario 4-14, suppose a randomly

Q245: Referring to Scenario 16-16, , what is

Q330: Referring to Scenario 11-12, the relative efficiency

Q403: To determine the probability of getting more