SCENARIO 12-20

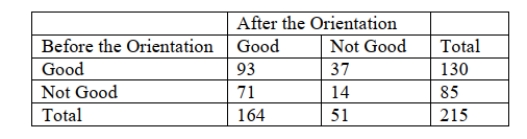

The director of the MBA program of a state university wanted to know if a one week orientation

would change the proportion among potential incoming students who would perceive the program as

being good. Given below is the result from 215 students' view of the program before and after the

orientation.

-Referring to Scenario 12-20, which test should she use?

Definitions:

Fund Returns

Fund Returns are the profits or losses from investments in mutual funds, ETFs, or other pooled investment vehicles, typically presented as a percentage gain or loss over a specific period.

Sharpe Measure

A financial metric used to assess the performance of an investment by adjusting for its risk.

Comparison Universe

The set of money managers employing similar investment styles, used for assessing the relative performance of a portfolio manager.

Mutual Funds

Investment programs funded by shareholders that trade in diversified holdings and are managed by professional investment managers.

Q5: Inc. Technology reported the results of

Q5: Consider the following model <span

Q59: Consider the partial printout for an

Q63: (2, -6) and (-1, 3) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4890/.jpg"

Q66: Consider the following pairs of measurements:

Q76: Stepwise regression is used to determine which

Q96: Which of the following yields a systematic

Q106: A study of the top 75

Q144: The chancellor of a major university was

Q236: Referring to Scenario 5-13, what is the