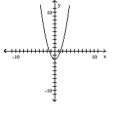

Select the equation that describes the graph shown.

Definitions:

Tax Rate Structure

The framework defining how different levels of income are taxed at various rates, often progressive, where higher income incurs higher tax rates.

Progressive

A tax system in which the tax rate increases as the taxable amount increases, placing a larger burden on those who have higher incomes.

Proportional

A tax system where the tax rate remains constant as the taxable amount increases.

Regressive

A tax system where the tax rate decreases as the taxable amount increases, leading to lower-income individuals bearing a proportionally higher tax burden.

Q2: through <span class="ql-formula" data-value="( -

Q64: Find an equation for a rational

Q115: <span class="ql-formula" data-value="f ( x ) =

Q141: An experienced accountant can prepare a

Q299: perpendicular to <span class="ql-formula" data-value="y

Q322: The linear function <span class="ql-formula"

Q393: <span class="ql-formula" data-value="3 \mathrm { i }

Q408: A circle has a diameter with

Q465: <span class="ql-formula" data-value="\frac { 4 + 2

Q494: <span class="ql-formula" data-value="2 [ 3 - (