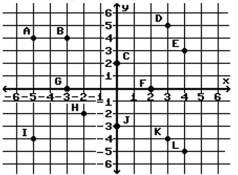

-(3, 5)

Definitions:

Treasury Stock

Shares that were once part of the outstanding shares of a company but were later reacquired by the company itself.

Deferred Tax Asset

A tax reduction or benefit that arises due to temporary differences between the book value and tax value of assets and liabilities, which can be used to offset future tax liabilities.

Income Taxes Payable

The amount of income tax a company owes to the government but has not yet paid, usually accumulated over a financial period.

Income Tax Expense

The amount of money a company owes in taxes based on its taxable income.

Q2: <span class="ql-formula" data-value="n = 10 , \bar

Q3: A small independent organic food store

Q5: Use the <span class="ql-formula" data-value="t"><span

Q20: Explain why the second plan suggested above,

Q36: The line through (-8, 2)and (-18, 0)and

Q47: The ratio of the lengths of strings

Q69: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5007/.jpg" alt="

Q74: <span class="ql-formula" data-value="| - 7 | <

Q130: <span class="ql-formula" data-value="25 y-5 x=-10"><span class="katex"><span class="katex-mathml"><math

Q267: A plane flies 440 miles with the