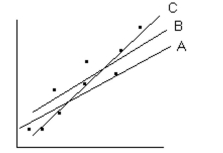

Select the best-fit line for the data on the scatter diagram. If none of the lines fit the data, write "none of the lines".

-Select the best-fit line on the scatter diagram below.

Definitions:

Equipment

Physical items purchased for use in operations of a business, often subject to depreciation for tax purposes.

Depreciation

The process of allocating the cost of a tangible asset over its useful lifespan, representing wear and tear, deterioration, or obsolescence.

Section 1250

Section 1250 of the U.S. Internal Revenue Code deals with the tax treatment of gains from the sale of depreciable real property, distinguishing between ordinary income and capital gains.

Short-term Loss

A financial loss realized on the sale or exchange of an asset held for one year or less.

Q10: A manufacturer wishes to test the

Q27: The table contains the weights (in

Q47: The data below represent the results

Q57: A national survey was done. It showed

Q67: Suppose that 11 fair coins are tossed.

Q68: Rolling a sum of 12 with two

Q94: Among a random sample of 150 employees

Q101: A teacher asked each of her

Q108: An article in a magazine examined the

Q153: <span class="ql-formula" data-value="\sqrt { 1410.7536 }"><span class="katex"><span