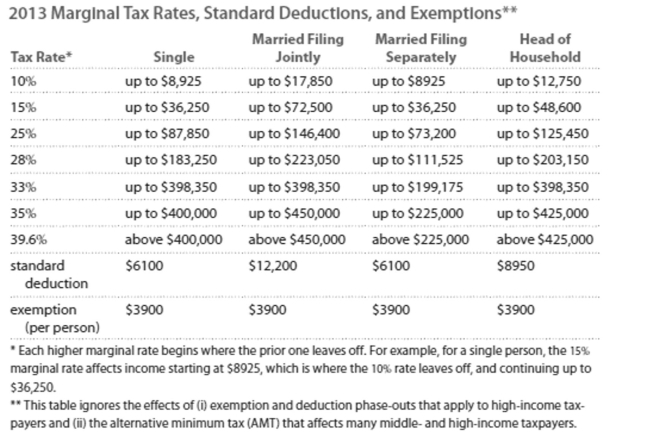

Solve the problem. Refer to the table if necessary.

-You are single and have a taxable income of $56,767. You make monthly contributions of $455 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred

Contribution.

Definitions:

Schizophrenic Disorder

A mental health disorder characterized by disturbances in thought, perception, and behavior, leading to a disconnection from reality.

Anxiety Disorder

A mental health disorder characterized by persistent and excessive worry, fear, or anxiety that interferes with daily activities.

Positive Symptoms

In psychology, symptoms that involve the presence of abnormal behaviors or experiences, such as hallucinations or delusions, often seen in schizophrenia.

Schizophrenia

A severe mental disorder characterized by distortions in thought, perception, emotions, language, sense of self, and behavior.

Q3: Which of the statements below suggests an

Q6: Assume that a distribution has a

Q48: The distance from the earth to

Q115: A bank offers an APR of

Q117: Which of the following quantities of interest

Q124: The amount of Jen's monthly phone

Q154: A couple under the age of 30

Q157: The speeds (in mi/h)of the cars

Q213: The total number of steps an adult

Q223: The maximum value of a distribution is