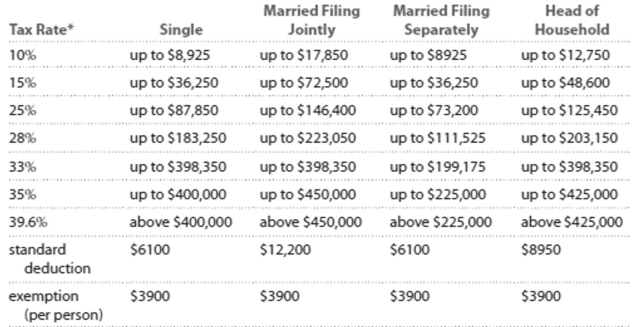

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Kevin is married, but he and his wife filed separately. His gross salary was $37,967, and he earned $448 in interest. He had $1141 in itemized deductions and claimed three exemptions for himself

And two children. Find his taxable income.

Definitions:

Capacity Utilization Rate

The percentage of a firm's total possible production capacity that is actually being used over a given period.

Global Economy

The interconnected networks of economic activities, trade, and investment transcending national borders, encompassing the production, distribution, and consumption of goods and services worldwide.

Importance

The state or fact of being of great significance or value.

Productive Efficiency

A situation where an economy or a production process is not able to produce more of one good without reducing the production of another good, operating on its production possibilities frontier.

Q1: With tax-exempt investments, you never have to

Q58: The local Tupperware dealers earned these

Q165: Write as a decimal.<br>78\%<br>A) <span

Q196: You invest $6000 in an account that

Q199: Suppose your after-tax income is $36,357. Your

Q206: In a poll of 1534 adults, 35%

Q213: The total number of steps an adult

Q224: Jim is in the 15% tax bracket

Q249: <span class="ql-formula" data-value="\begin{array} { l l l

Q257: Suppose that the mean salary in