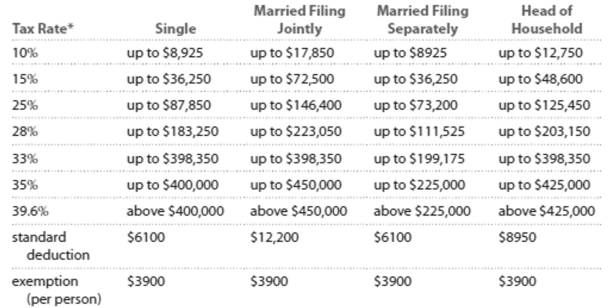

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

" Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Caitlin is single and earned wages of $32,988. She received $300 in interest from a savings account. She contributed $479 to a tax-deferred retirement plan. She had $530 in itemized deductions from

Charitable contributions. Calculate her gross income.

Definitions:

Antisocial Behavior

Actions that harm or lack consideration for the well-being of others; often against societal norms or laws.

Individuality Corollary

A principle that acknowledges the uniqueness of each individual's perception and understanding of the world, as proposed by George Kelly's personal construct theory.

Kelly's

Pertains to George Kelly's Personal Construct Theory, which focuses on how people create constructs as mental models to interpret the world.

Opinions

Beliefs or judgments that are not based on certainty or knowledge but rather on what one thinks or feels to be true or probable.

Q2: The average amount spent on food last

Q3: How does world population in the year

Q14: Number of siblings of adults in the

Q139: A pharmaceutical company wants to test its

Q140: Scores on a test are normally distributed

Q141: _ <span class="ql-formula" data-value="\% \text {

Q148: How does the share price for

Q180: As a marketing executive for a computer

Q186: A data value in the 16th

Q212: The time it take Claudia to