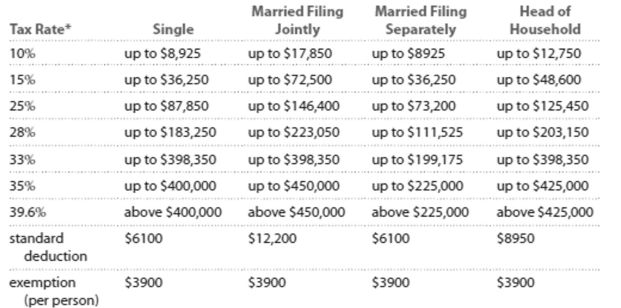

Solve the problem. Refer to the table if necessary.

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Tom and Toni are married and file jointly. Their combined wages were $78,148. They earned a net of $1593 from a rental property they own, and they received $1665 in interest. They claimed four

Exemptions for themselves and two children. They contributed $3364 to their tax-deferred

Retirement plans, and their itemized deductions total $10,516. Find their taxable income.

Definitions:

Exchange Tactic

A strategy used in negotiations or interactions, where one party offers something in return for something from the other party.

Explicit Offers

Direct and clear proposals or opportunities presented by one party to another, leaving little to no room for misunderstanding or ambiguity.

Promised Benefit

An expected or assured advantage that is to be delivered as a result of an action or a transaction.

Resistance

The act of opposing or standing against certain ideas, changes, or directives, often seen in organizational or social contexts.

Q15: Round to the nearest thousandth: 3.83366<br>A)3.8337<br>B)3.835<br>C)3.833<br>D)3.834

Q35: The following table shows the number

Q72: The amount of coffee which a filling

Q132: Over the last 10 years in this

Q136: <span class="ql-formula" data-value="15,42,53,7,9,12,14,28,47"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>15</mn><mo separator="true">,</mo><mn>42</mn><mo

Q167: Find the scale ratio for a map

Q183: If two accounts offer the same APR,

Q186: Which of the following describes a study

Q187: You want to have a $40,000 college

Q189: The graph below shows estimated world