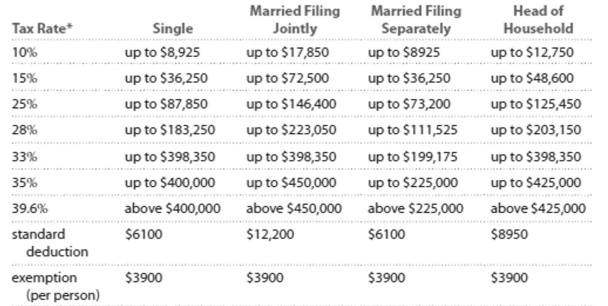

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Bill earned wages of $47,227, received $1837 in interest from a savings account, and contributed $ 3010 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $7719. Find his adjusted gross income.

Definitions:

Negative Value

A negative value represents a number less than zero, often indicating a deficit or reduction in mathematical and statistical contexts.

Normal Distribution

A bell-shaped probability distribution that is symmetric about the mean, showing that data near the mean are more frequent in occurrence.

Mean

The average value of a set of numbers, calculated by dividing the sum of all values by the number of values.

Standard Normal Deviate

Another term for Z-score, highlighting its role in standard normal distribution.

Q5: There are 20 bags filled with coins

Q9: An educational researcher wishes to compare the

Q42: Andy earned $74,358 from wages as an

Q69: <span class="ql-formula" data-value="0.05 \times 10 ^ {

Q78: Anna deposits $2500 in a savings account

Q82: In a poll of 1093 college students,

Q83: You want to know the percentage of

Q156: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" A) Normal B)

Q158: You invest $800 in an account that

Q232: You just put $4399 in a CD