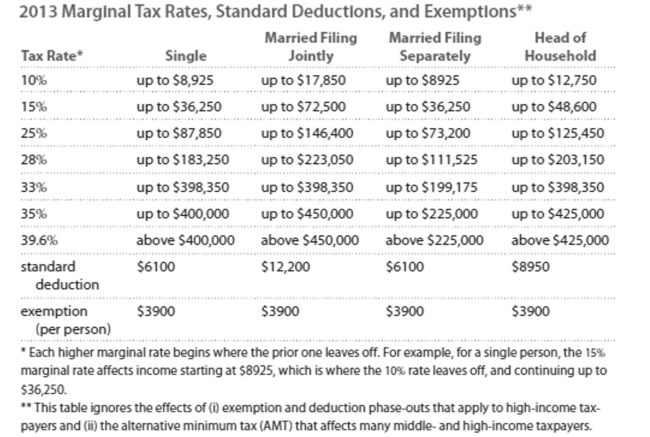

Solve the problem. Refer to the table if necessary.

-Carla earned wages of $53,687, received $1731 in interest from a savings account, and contributed $ 2999 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $7180. Find her gross income.

Definitions:

Base Year

The base year is a specific point in time used as a reference or benchmark for economic or financial calculations, such as index numbers and inflation measurements.

Percentage Changed

A measure that calculates the degree of change over time, indicating growth or decline in specific variables.

Monopsony Power

A market condition where there is only one buyer for a product or service, giving the buyer significant power over prices and terms.

Workers

Individuals engaged in any form of employment, providing labor to produce goods or deliver services in exchange for wages, salaries, or other forms of compensation.

Q54: Write as a fraction. 7.625% <br>A)

Q59: I drove really far, almost 200 kilometers

Q61: Suppose it cost $4.16 to fill

Q65: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" Identify the utility

Q113: If I pay off my mortgage in

Q114: As Thomas's income rose over the last

Q130: Tech Support spent $18,450 this year on

Q135: <span class="ql-formula" data-value="\frac { 6 } {

Q183: <span class="ql-formula" data-value="A = 36 \pi"><span class="katex"><span

Q220: <span class="ql-formula" data-value="6.234 \times 10 ^ {