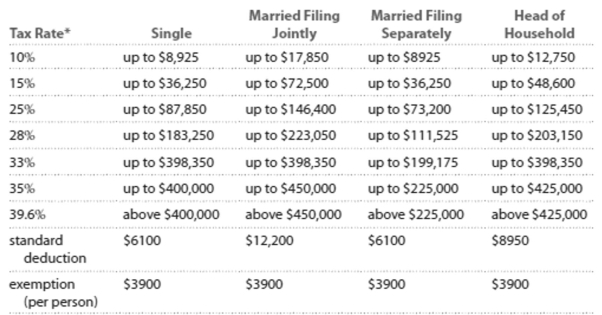

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to \$36,250.

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Ken is head of household with a dependent child and a taxable income of $91,691. He also is entitled to a $1000 tax credit. Calculate the amount of tax owed.

Definitions:

Leader Traits

Characteristic attributes such as personality, social skills, and physical attributes that are often associated with effective leadership.

Leadership Effectiveness

The extent to which a leader is able to achieve desired outcomes through guiding and influencing others.

Leader Behaviours

Actions and attitudes demonstrated by leaders that influence the motivation, performance, and well-being of followers.

Leadership Categorization Theory

A theory suggesting that people evaluate leaders based on how closely the leaders’ attributes match stereotypical or prototype attributes of leaders.

Q18: $10,000 deposit at an APR of 4%

Q50: 4500<br>A)2 significant digits, precise to the nearest

Q58: The book contains <span class="ql-formula"

Q68: For the study described below, identify the

Q70: The amount of property taxes paid by

Q79: Allison weighs 29% less than she did

Q95: <span class="ql-formula" data-value="\left( 6 \times 10 ^

Q146: A bank offers an APR of 2.4%

Q155: The table shows the results of a

Q212: Following the Republican National Convention, a poll