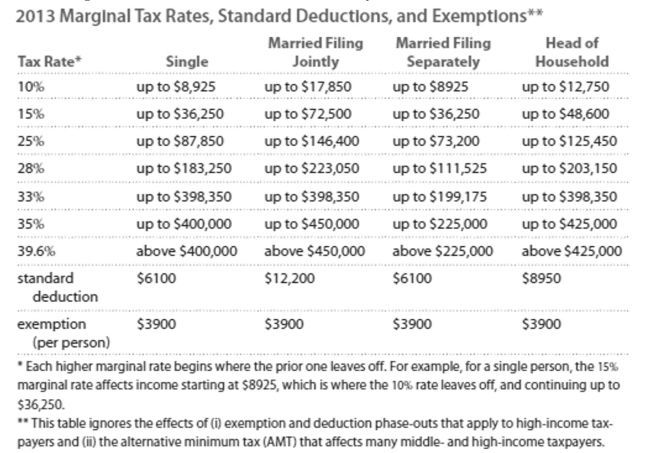

Solve the problem. Refer to the table if necessary.

-Jenny earned wages of $99,016, received $5325 in interest from a savings account, and contributed $ 5935 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $8971. Find her taxable income.

Definitions:

Short-Run Economic Recession

A brief period of economic decline characterized by reduced industrial production, trade, and lowered levels of employment.

Long-Run Aggregate-Supply Curve

A vertical curve representing the real output of goods and services that an economy can produce when resources are fully employed, irrespective of the overall price level, over time.

Short-Run Equilibrium

A state in which market supply and demand balance each other, and as a result, prices become stable temporarily.

Money Supply

At any given time, the total economic assets available in an economy, which consist of cash, coins, and the balances in checking and savings accounts.

Q24: I am young and I'm going to

Q26: 17 liters to gallons<br>A)16.1 gallons<br>B)18 gallons<br>C)64.3 gallons<br>D)4.5

Q34: A single 31-year old man with a

Q35: 3.5 cases is % of 19.6 cases.<br>A)17.9<br>B)5.6<br>C)560.0<br>D)0.2

Q52: An outlet store had monthly sales of

Q121: The credit card APR is 19% and

Q174: 110,000<br>A) <span class="ql-formula" data-value="1.1 \times

Q198: Suppose that the proportion of left

Q231: Anne counts the number of cars passing

Q283: Which of the statements below suggests an