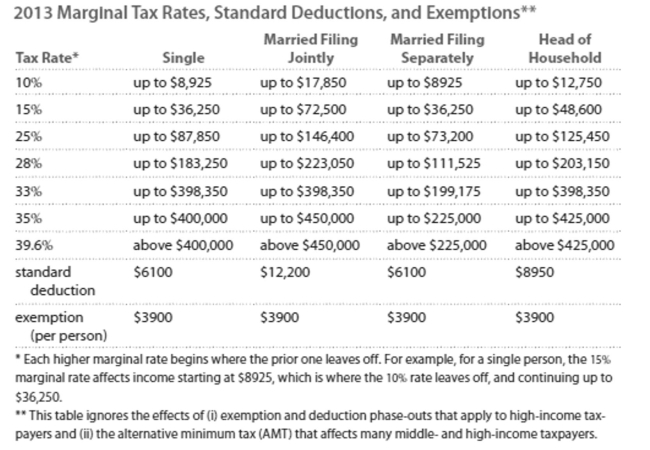

Solve the problem. Refer to the table if necessary.

-Jeff earned wages of $48,267, received $1837 in interest from a savings account, and contributed $ 3210 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $7314. Find his taxable income.

Definitions:

Financial Risk

The possibility of losing money on an investment or business venture.

Project Completion

The final stage in a project where all tasks have been finished and the project objectives have been met.

SDLC

The Software Development Life Cycle is a methodology used for organizing, developing, testing, and launching an information system.

First Stage

The initial phase in a process or sequence of events, often setting the groundwork or foundation for subsequent stages.

Q27: _ <span class="ql-formula" data-value="\text {

Q48: Which of the following describes a study

Q66: The population of a small country

Q78: Which of the following is likely the

Q106: A curved bridge rises over a river,

Q137: The following table shows the deaths due

Q172: An agency wishes to determine the number

Q176: The bar graph below shows the average

Q260: <span class="ql-formula" data-value="7 x + 8 =

Q276: 1 trillion, 1 hundred <br>A)