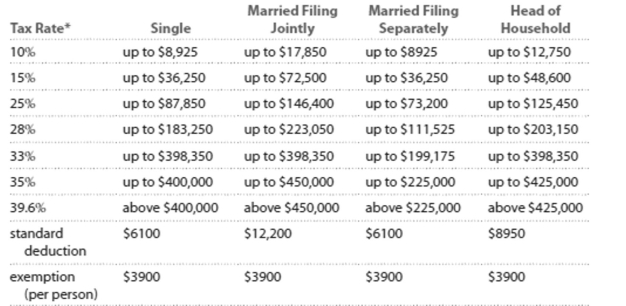

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Abbey earned $70,218 in wages. Kathryn earned $70,218, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

Definitions:

Skills Inventories

Databases or lists of the skills and qualifications that employees possess, used for managing and planning human resources.

HR Demand Requirements

The specific needs and number of human resources an organization requires to meet its strategic objectives and goals.

Capabilities

The combination of skills, resources, and abilities that an organization possesses to perform its functions effectively.

External Environmental Supply

Pertains to the external sourcing of resources or inputs that a company needs from its external environment to operate effectively.

Q10: <span class="ql-formula" data-value="\begin{array}{cc}\hline \begin{array}{l}\text { Computers }

Q13: <span class="ql-formula" data-value="984 \div 0.00869 ; 3"><span

Q99: An environmental group believes that the

Q112: A researcher finds a positive correlation between

Q112: A warehouse is 42 yards long

Q130: Tech Support spent $18,450 this year on

Q137: The following table shows the deaths due

Q160: Round to the nearest tenth: 12.559<br>A)12.6<br>B)12.7<br>C)12.56<br>D)12.5

Q211: Last month the average waiting time

Q247: Niyas is starting a college fund for