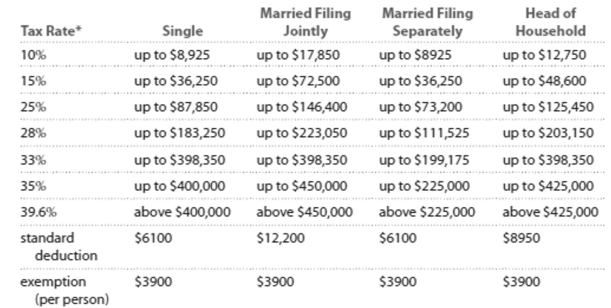

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-You are married filing jointly and have a taxable income of $287,874. You make monthly contributions of $1095 to a tax-deferred savings plan. Calculate the effect on annual take-home pay

Of the tax-deferred contribution.

Definitions:

Tax Authority

A governmental entity responsible for the administration of taxes, including collection, enforcement, and interpretation of tax laws.

Legislative

Pertaining to the branch of government responsible for creating laws.

Private Letter Rulings

Issued by the IRS, these are written decisions provided to taxpayers, offering guidance on the tax treatment of complex transactions.

Tax Treatment

The specific way tax laws apply to different types of income, expenses, and individuals.

Q3: <span class="ql-formula" data-value="\frac { 10 ^ {

Q3: The average annual percentage yield (APY)that would

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" A)

Q29: In a survey to assess attitudes toward

Q44: The customer bought a peck of

Q56: Which of the following describes the bias

Q79: nanometer, meter <br>A) Smaller by a

Q101: Which of the following quantities of interest

Q129: Suppose you start saving today for a

Q241: <span class="ql-formula" data-value="5.4"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>5.4</mn></mrow><annotation encoding="application/x-tex">5.4</annotation></semantics></math></span><span