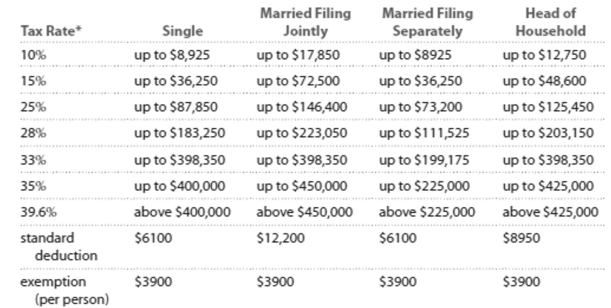

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Mark earned $40,208 from wages as a mechanic and made $1539 in interest. Calculate his FICA tax.

Definitions:

Parathyroid Hormone

A substance secreted by the parathyroid glands responsible for controlling blood calcium concentrations and bone metabolism.

Synergistically

In cooperation such that the result or effect is greater than the sum of individual effects.

Digestive Tract

A series of hollow organs joined in a long, twisting tube from the mouth to the anus where digestion and nutrient absorption occurs.

Bone

A hard, dense connective tissue that forms the structural elements of the skeleton in vertebrates.

Q20: For the study described below, identify the

Q36: cubic micrometer, cubic meter <br>A) Smaller

Q54: Main form of exercise for employees

Q75: The table shows the unemployment rate

Q84: <span class="ql-formula" data-value="\frac { 1 } {

Q104: Write as a fraction. 30% <br>A)

Q106: The time series line chart below shows

Q107: <span class="ql-formula" data-value="\left( 25 \times 10 ^

Q169: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" A)Weak positive correlation

Q184: Keiko pays $320 per month for food,