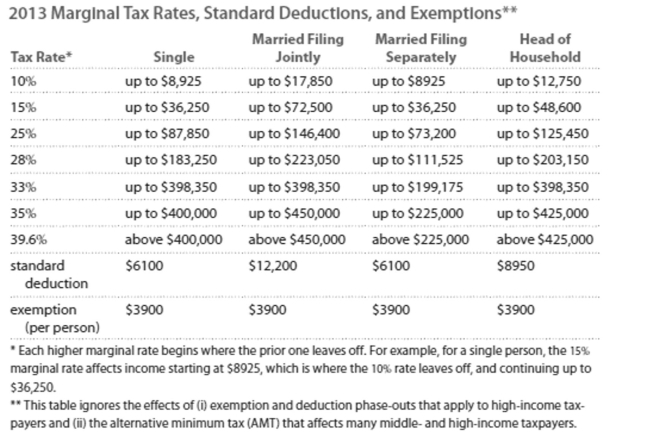

Solve the problem. Refer to the table if necessary.

-You are single and have a taxable income of $56,767. You make monthly contributions of $455 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred

Contribution.

Definitions:

Standard Performance

The established or expected level of output, quality, or efficiency that employees are expected to achieve.

Self-Appraisal

An evaluation process in which an individual assesses their own performance, strengths, and areas for improvement, typically within a professional context.

Appraisal Process

The sequence of steps involved in evaluating an employee's performance, typically involving feedback and discussions about achievements and areas for improvement.

Realistically

Pertains to recognizing and accepting the actual nature of a situation in a practical and sensible manner.

Q112: $16,000 is invested at an APR of

Q124: <span class="ql-formula" data-value="\left( 20 \times 10 ^

Q130: Time spent walking and distance walked<br>A)Weak negative

Q179: The diameters of bolts produced by

Q184: Scores on a test are approximately normally

Q200: In a random sample of 250 births

Q201: There are 503,324,152 flowers in the botanical

Q220: Paul figures that at today's prices he

Q233: John is married filing separately with taxable

Q251: The unemployment rate in Midtown a