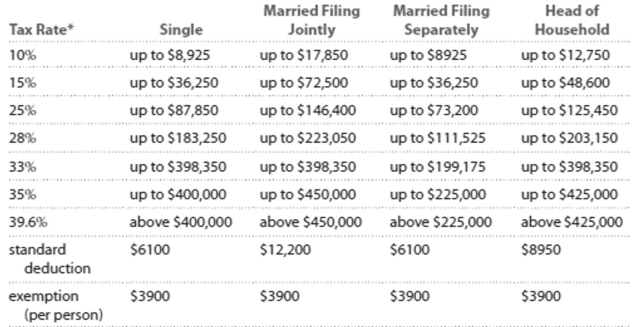

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Kevin is married, but he and his wife filed separately. His gross salary was $37,967, and he earned $448 in interest. He had $1141 in itemized deductions and claimed three exemptions for himself

And two children. Find his taxable income.

Definitions:

Mainstream Media

Refers to the most widely available and commonly consumed forms of media, including television, newspapers, and radio, which have a significant influence on public opinion.

Portrayed

Describes the act of depicting someone or something in a work of art or literature.

Media Concentration

The phenomenon where fewer individuals or organizations control increasing shares of mass media.

Perspectives

Different ways of viewing or interpreting events, ideas, or situations, influenced by individual experiences, beliefs, and knowledge.

Q33: <span class="ql-formula" data-value="8 n - 10 =

Q35: 3.5 cases is % of 19.6 cases.<br>A)17.9<br>B)5.6<br>C)560.0<br>D)0.2

Q86: Your weight is 127 pounds but

Q109: Cathy scored 7 times as much as

Q121: Last year, nine employees of an

Q158: A TV show announced that their survey

Q206: Suppose the current cost of gasoline is

Q232: You just put $4399 in a CD

Q256: Maria saved $1750 in taxes after donating

Q269: Which of the statements below suggests an