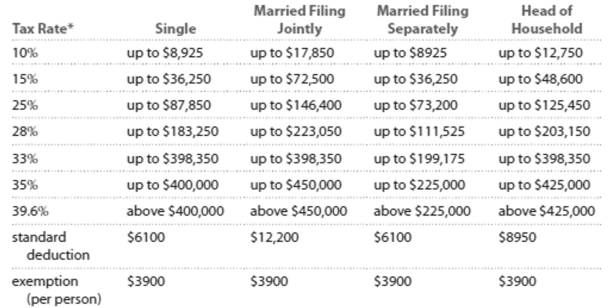

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

" Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Caitlin is single and earned wages of $32,988. She received $300 in interest from a savings account. She contributed $479 to a tax-deferred retirement plan. She had $530 in itemized deductions from

Charitable contributions. Calculate her gross income.

Definitions:

Industry Cost

The total expenses incurred by firms operating within a specific industry, including production, labor, and capital costs.

Demand Conditions

pertain to the nature and size of the market demand for products or services in a given industry, influencing competitive strategy and innovation.

Pure Monopolist

A single seller in a market with no close substitutes for the product, giving the seller significant control over prices.

Maximum Profit

The highest possible financial gain a business can achieve from its operations, given its costs and revenue structure.

Q93: You could take a 15-week, three-credit college

Q95: If you complete the four-step problem-solving process

Q95: On a math test, the scores

Q96: The heights of nine different mountains

Q117: A state governor is planning a tax

Q172: Consider an account with an APR of

Q186: You have covered 72.6 miles of a

Q194: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3069/.jpg" alt=" A) Strong negative

Q199: <span class="ql-formula" data-value="A = 18"><span class="katex"><span class="katex-mathml"><math

Q222: <span class="ql-formula" data-value="( x - 2 )