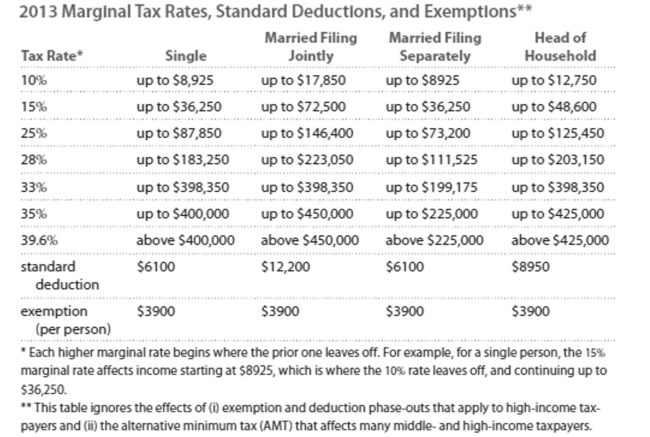

Solve the problem. Refer to the table if necessary.

-Carla earned wages of $53,687, received $1731 in interest from a savings account, and contributed $ 2999 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $7180. Find her gross income.

Definitions:

Economists

Experts who study the production, distribution, and consumption of goods and services.

Interest Rate

The amount charged by lenders to borrowers for the use of money, expressed as a percentage of the principal.

Interest Rates

The cost of borrowing money or the return on invested capital, expressed as a percentage of the principal amount.

Investment

The procedure or operation of assigning financial assets with the intention of achieving a revenue or profit.

Q13: In which year was the value of

Q18: You want to know the average amount

Q75: Calculate the monthly payment for a student

Q77: At a certain college, the percentage

Q146: A bank offers an APR of 2.4%

Q165: Resting heart rates for adults<br>A)Normal<br>B)Not normal

Q171: If you score 70% on the midterm

Q175: A pharmaceutical company conducted a study to

Q196: The unemployment rate and the number of

Q239: Four years after buying 800 shares