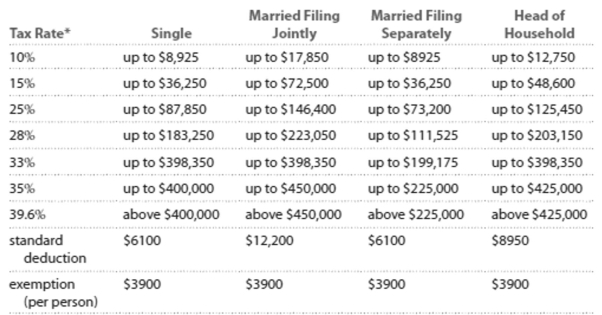

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to \$36,250.

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Kyle is single and earned wages of $34,036. He received $362 in interest from a savings account. He contributed $549 to a tax-deferred retirement plan. He had $405 in itemized deductions from

Charitable contributions. Calculate his adjusted gross income.

Definitions:

Married Persons

Individuals who are legally joined in matrimony, a state that entails certain legal rights, responsibilities, and social recognition.

Divorced Persons

Individuals who have legally terminated their marriage.

Kamikaze Pilots

Members of the Japanese military during World War II who executed suicide missions, crashing their aircraft loaded with explosives into enemy targets.

Rational Suicide

Suicide in which the individual is not insane and is aware of what he or she is doing.

Q23: Round to the nearest tenth: 0.5715<br>A)0.5<br>B)0.7<br>C)0.57<br>D)0.6

Q33: Suppose you needed $43,000 to maintain a

Q93: In a survey, 20 voters were

Q94: <span class="ql-formula" data-value="2 ^ { 2 }

Q144: gigagram, microgram <br>A) Larger by a

Q155: Number of days worked last year by

Q158: <span class="ql-formula" data-value="7,15,14,10,10,9,19,19,12"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mn>7</mn><mo separator="true">,</mo><mn>15</mn><mo

Q160: In a poll of 1082 college

Q253: In a survey of 125 adults, 30%

Q254: Amount of credit card debt of families