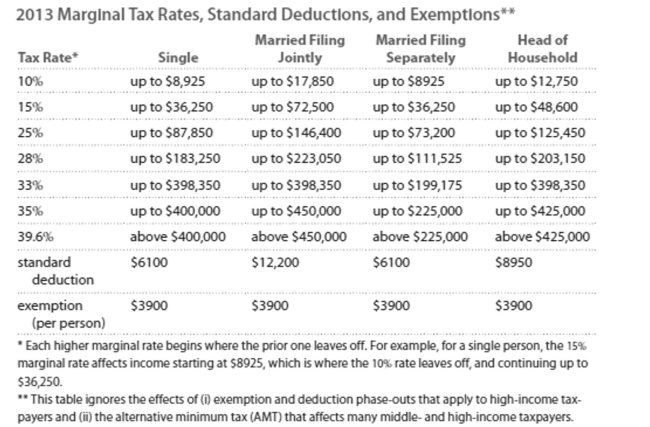

Solve the problem. Refer to the table if necessary.

-Carmen and James are married and filed jointly. Their combined wages were $91,109. They earned a net of $1887 from a rental property they own, and they received $1595 in interest. They

Claimed four exemptions for themselves and two children. They contributed $3701 to their

Tax-deferred retirement plans, and their itemized deductions total $9765. Find their adjusted gross

Income.

Definitions:

Equity Method

An accounting technique used to record an investor's proportional share of the profits and losses of an equity-invested company.

Stock

Shares of ownership of a corporation.

Brokerage Commission

A fee charged by a broker for executing a transaction or providing specialized services.

Accrued Interest

Interest that has accumulated over time but has not yet been paid or received.

Q3: Which of the statements below suggests an

Q65: <span class="ql-formula" data-value="\text { Convert a lot

Q114: <span class="ql-formula" data-value="4 ^ { 5 }

Q118: Suppose that China's population policy is modified

Q172: An agency wishes to determine the number

Q185: Which of the following is likely a

Q194: The race speeds for the top

Q210: % of 47 clients is 459 clients.<br>A)0.1<br>B)976.6<br>C)97.7<br>D)1.0

Q218: The speed of light is approximately 5,866,000,000,000

Q243: The percentage of registered voters who voted