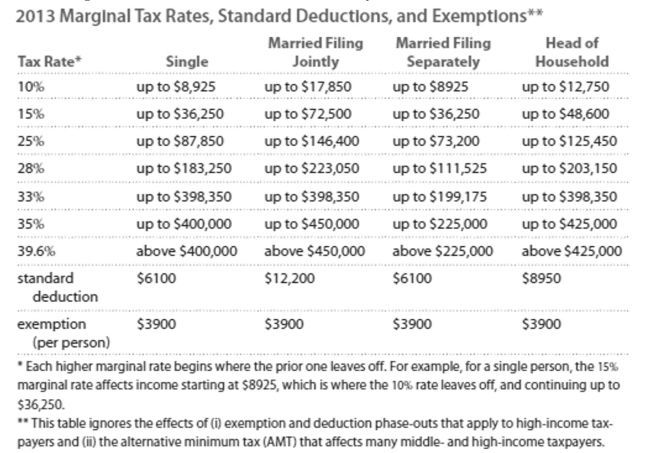

Solve the problem. Refer to the table if necessary.

-Jenny earned wages of $99,016, received $5325 in interest from a savings account, and contributed $ 5935 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $8971. Find her taxable income.

Definitions:

Alzheimer's Disease

A neurological condition that advances over time, leading to the loss of memory, decline in cognitive abilities, and alterations in personality.

Mindfulness Meditation

A meditation practice that focuses on cultivating mindfulness by paying attention to thoughts, feelings, and sensations in the present moment.

Aerobic Exercise

Physical activity that improves the efficiency of the cardiovascular system in absorbing and transporting oxygen, such as running, swimming, or cycling.

Premature Infants

are babies born before 37 weeks of gestation and may require special medical care.

Q46: Last year the total revenue for

Q53: Calculate the current yield for a $1000

Q61: <span class="ql-formula" data-value="\frac { 10 ^ {

Q67: A _ represents money that is borrowed

Q173: You are in the 25% tax bracket.

Q186: Which of the following describes a study

Q196: The unemployment rate and the number of

Q207: <span class="ql-formula" data-value="\begin{array} { c c }

Q250: Principal: $950 Rate: 3% Years: 6<br>A)$13.35<br>B)$963.35<br>C)$792.35<br>D)$8.81

Q250: <span class="ql-formula" data-value="6.500 \times 10 ^ {