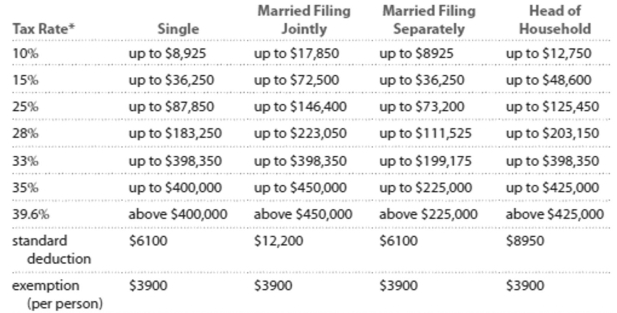

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

"Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Kelly earned wages of $87,240, received $4814 in interest from a savings account, and contributed $ 6070 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $9049. Find her gross income.

Definitions:

Structured Programming Principles

Structured Programming Principles are a subset of programming paradigms that suggest programs should be divided into functions and follow strict sequences, selections, and loops.

Continue Statement

A control statement that causes the loop to immediately jump to the next iteration, skipping any code in between.

Counter-Controlled Loop

A loop that uses a counter variable to control the number of times the loop executes, incrementing or decrementing with each iteration.

Q69: A swimming pool 3 meters deep,

Q86: For women at Hartford College, times to

Q93: You could take a 15-week, three-credit college

Q96: I figured out the number of seconds

Q122: Your car gets 33 miles per gallon

Q136: A community garden contains 25 rectangular

Q208: A government census fails to include homeless

Q212: Following the Republican National Convention, a poll

Q223: The maximum value of a distribution is

Q254: <span class="ql-formula" data-value="3 \times 10 ^ {