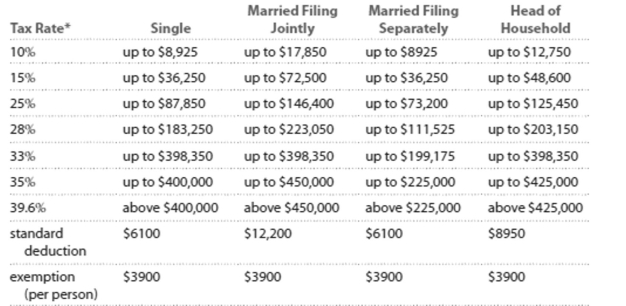

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Abbey earned $70,218 in wages. Kathryn earned $70,218, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

Definitions:

Book Value

The value of an asset as shown on a company's balance sheet, calculated as the cost of the asset minus any depreciation and amortization.

Capital Balance

The amount of funds contributed by owners or shareholders to a business, plus retained earnings and reduced by any withdrawals or distributions.

Asset Revaluation

The process of adjusting the book value of an asset to reflect its current market value.

Capital Balances

refers to the amount of money stakeholders have invested in a company, recorded in the equity section of the balance sheet.

Q28: <span class="ql-formula" data-value="3.0223 \times 10 ^ {

Q32: <span class="ql-formula" data-value="5.4 \times 10 ^ {

Q55: When scientists estimate the height of a

Q60: Ten years ago, according to government

Q78: <span class="ql-formula" data-value="3.531 \times 10 ^ {

Q91: gram, milligram <br>A) Larger by a

Q138: <span class="ql-formula" data-value="8 x - 10 =

Q203: Suppose that you want to construct

Q220: <span class="ql-formula" data-value="6.234 \times 10 ^ {

Q236: Find the gasoline price index for