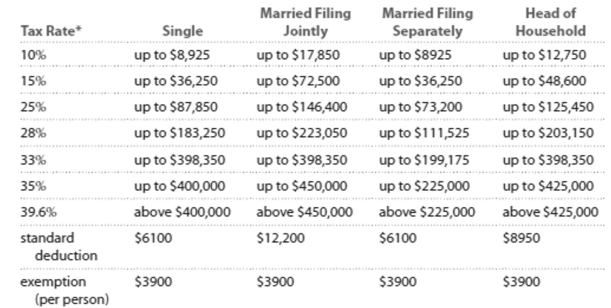

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Mark earned $40,208 from wages as a mechanic and made $1539 in interest. Calculate his FICA tax.

Definitions:

Feminism Wave

Phases of feminism focused on addressing different issues and goals, typically identified as first, second, third, and sometimes fourth waves.

Scholars

Individuals engaged in the rigorous study of academic subjects and the advancement of knowledge.

Sociologists

Experts in the study of societal patterns, social relationships, and the functioning of societies, focusing on the development, structure, and systematic issues.

Activists

Individuals who engage in intentional actions to bring about social, political, economic, or environmental change.

Q70: Short-term capital gains are profits on items

Q72: <span class="ql-formula" data-value="x ^ { 2 }

Q81: Your electrical bill states that you used

Q82: Kerry invests $362 in a savings

Q90: 2500 square yards to square meters<br>A)2992.1 square

Q97: 8,099,140<br>A) <span class="ql-formula" data-value="8.09914 \times

Q122: Suppose you are constructing a scale model

Q143: Suppose it cost $16.19 to fill

Q164: If you buy an item (such as

Q240: The total number of cups of coffee