Determine the specified calculation.

-

Definitions:

Straight-Line Method

A method of calculating depreciation or amortization by evenly spreading the cost of an asset over its useful life.

Depreciation Expense

An accounting method to allocate the cost of a tangible asset over its useful life, reflecting wear and tear, deterioration, or obsolescence.

Residual Value

The estimated value of an asset at the end of its useful life.

Double Diminishing-Balance

A method of accelerated depreciation that computes depreciation at double the rate of the straight-line method.

Q6: <span class="ql-formula" data-value="\begin{array}{r|rrrrrrr}\mathrm{x} & 57 & 53

Q18: For a <span class="ql-formula" data-value="\chi

Q25: Ten different families are tested for

Q27: Test scores for a random sample

Q42: A company which designs sports shoes has

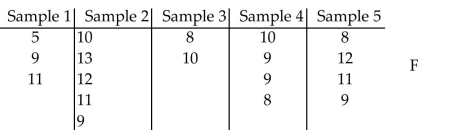

Q47: A one-way ANOVA is to be

Q51: What assumptions are made when using a

Q54: A relative frequency histogram for the heights

Q71: 196, 205, 215, 185, 229, 278, 165

Q126: You are dealt two cards successively (without