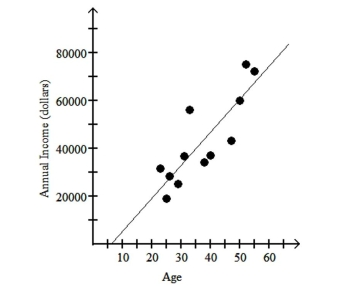

The table below shows the age and annual income of 12 randomly selected college graduates all living in the city of Seattle.

Would it be reasonable to use the regression equation to predict the annual income of a college Graduate in Seattle who is 90 years old? Explain your answer.

Definitions:

DCF Approach

The Discounted Cash Flow approach, a valuation method used to estimate the value of an investment based on its future cash flows.

Cost of Equity

The return a company requires to decide if an investment meets capital return requirements, often calculated using the Capital Asset Pricing Model (CAPM).

WACC Calculation

The process of determining a company's Weighted Average Cost of Capital, incorporating the costs of equity, debt, and any other forms of financing.

Semiannually

Occurring twice a year, generally used in the context of payments, interest accruals, or reports.

Q9: A company which designs sports shoes has

Q29: Use a 95% family confidence level.

Q32: The following table shows the average

Q40: In a random sample of 360 women,

Q43: A set of data consists of

Q48: Lifetimes (in hours)for a random sample

Q52: A fire-science specialist tests three different

Q72: The test scores of 15 students

Q93: A nutritionist wants to investigate whether

Q155: Suppose you wanted to construct a