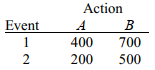

SCENARIO 20-2

The following payoff matrix is given in dollars.

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2,what is the optimal action using the EMV criterion?

Definitions:

Noncash Investing

Investment activities that affect the long-term assets of a company but do not result in cash outlays in the immediate term.

Financing Activities

Transactions that involve raising funds to finance the company's operations and expansions, such as issuing stocks or bonds.

Investing Activities

Transactions involving the purchase or sale of long-term assets and investments not included in cash equivalents.

Direct Method

A cash flow statement presentation method that shows the specific sources and uses of cash, detailing actual cash received and paid.

Q7: Referring to Scenario 18-4, the value of

Q9: The table below shows the total

Q20: True or False: Referring to Scenario 18-6,

Q22: Referring to Scenario 15-1, what is the

Q43: Blossom's Flowers purchases roses for sale for

Q59: Referring to Scenario 20-1, if the probability

Q77: A physician and president of a Tampa

Q78: Referring to Scenario 20-5, what is the

Q92: A <span class="ql-formula" data-value="\chi ^

Q133: A pizza chain is considering opening a