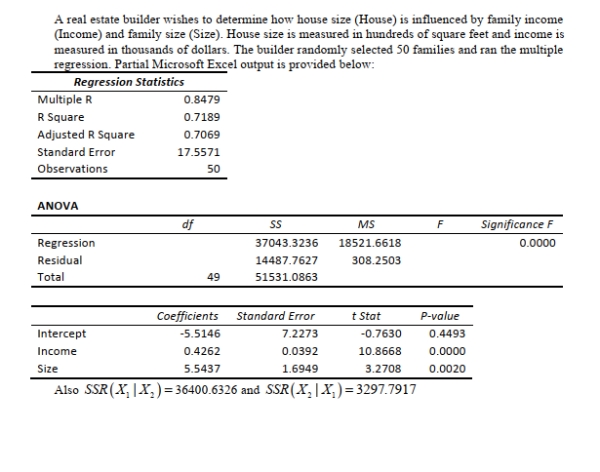

SCENARIO 14-4

14-10 Introduction to Multiple Regression

-Referring to Scenario 14-4, which of the following values for the level of significance is the

Smallest for which the regression model as a whole is significant?

Definitions:

Scanlon Plan

A type of gain-sharing program that rewards employees for contributions to productivity improvements through cost savings, emphasizing teamwork and participation.

Future Cost

Predicted financial expenditure associated with an action or decision, considering potential increases in prices or changes in resource availability.

Labour

The human effort, whether physical or mental, that is applied to the production of goods and services.

Goal-Sharing Plans

A type of incentive plan where employees are rewarded if collective goals are achieved, promoting teamwork and collaboration.

Q5: The Wall Street Journal recently ran an

Q28: Referring to Scenario 18-6, in terms of

Q30: Referring to Scenario 13-7, to test whether

Q37: Referring to Scenario 13-5, the partner wants

Q37: Data on the amount of money made

Q39: An entrepreneur is considering the purchase of

Q57: In testing for differences between the median

Q64: Dashboards may contain all but which of

Q78: Which of the following situations suggests a

Q88: The probability that a particular brand of