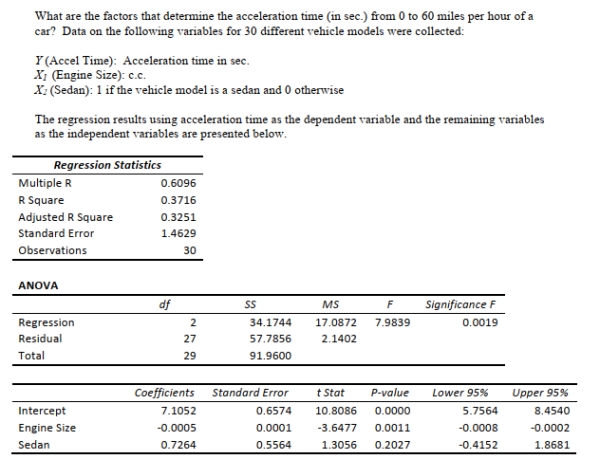

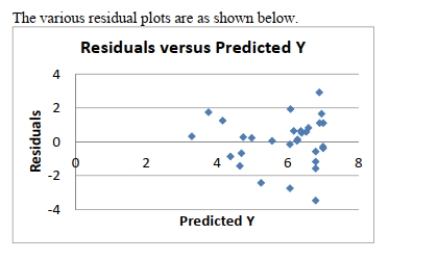

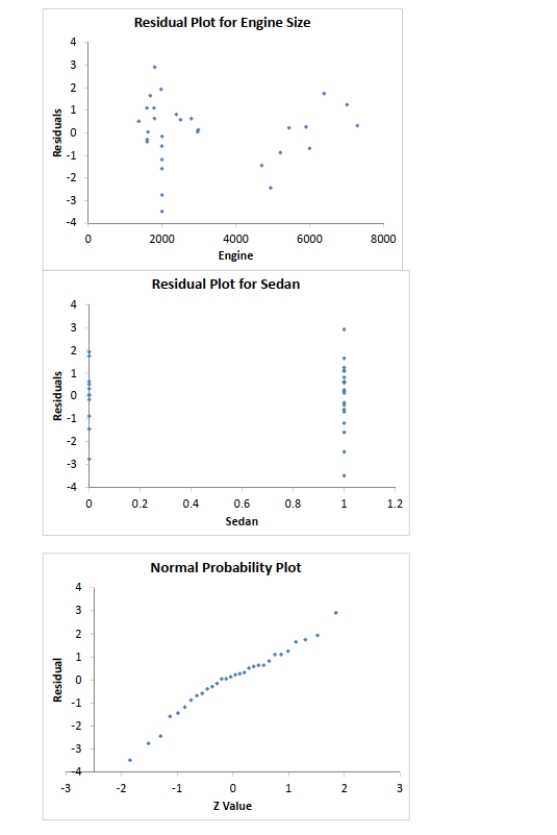

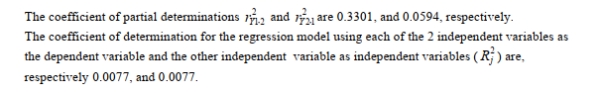

SCENARIO 14-16

14-64 Introduction to Multiple Regression

Introduction to Multiple Regression 14-65

-True or False: Referring to Scenario 14-16, the 0 to 60 miles per hour acceleration time of a

sedan is predicted to be 0.7264 seconds lower than that of a non-sedan with the same engine size.

Definitions:

Acquisition Differential

The difference between the purchase price of an acquired company and the fair value of its identifiable net assets, often accounted for as goodwill or amortized over time.

Impairment Losses

Financial losses recognized when the carrying amount of an asset exceeds its recoverable amount, indicating the asset is not worth its current value on the balance sheet.

Consolidated Retained Earnings

Represents the cumulative amount of net income earned by a parent company and its subsidiaries over time, after dividends are paid to shareholders, consolidated to a single figure.

Consolidated Statement

A financial statement that aggregates the assets, liabilities, equity, income, expenses, and cash flows of a parent company and its subsidiaries to reflect the total financial position and results of the group.

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2675/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q13: True or False: A test for the

Q22: The least squares method minimizes which of

Q23: Referring to Scenario 10-2, what is the

Q26: True or False: Referring to Scenario 17-7,

Q30: Referring to Scenario 10-7, what is the

Q44: When a time series appears to be

Q53: A powerful women's group has claimed that

Q65: Referring to Scenario 13-11, what is the

Q109: True or False: Referring to Scenario 18-9,