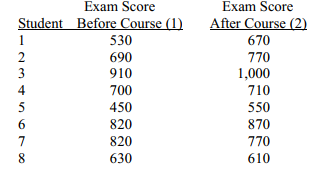

SCENARIO 10-5

To test the effectiveness of a business school preparation course,8 students took a general business test before and after the course.The results are given below.

-Referring to Scenario 10-5,the value of the standard error of the difference scores is

Definitions:

Par Value

The nominal or face value of a bond, share, or other financial instrument, as stated by the issuer.

Effective Interest Method

An accounting technique for amortizing bond premium or discount over the life of the bond in a way that reflects a constant interest rate.

Amortization Table

A schedule that details each payment on an amortizing loan (such as a mortgage), including how much of each payment is interest vs. principal and the remaining balance.

Semiannual Interest

Semiannual interest is interest that is calculated and paid twice a year on investments or loans.

Q14: Which of the following would be an

Q38: If the plot of the residuals is

Q38: You were told that the amount of

Q40: True or False: If the amount of

Q54: Referring to Scenario 16-14, to obtain a

Q67: True or False: Referring to Scenario 8-7,

Q70: True or False: Referring to Scenario 8-7,

Q71: Referring to Scenario 10-8, suppose Pepsi wanted

Q73: Referring to Scenario 12-7, the expected cell

Q93: Referring to Scenario 14-3, the p-value for