SCENARIO 5-1 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-1

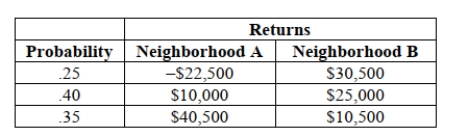

There are two houses with almost identical characteristics available for investment in two different

neighborhoods with drastically different demographic composition.The anticipated gain in value

when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-1, if you can invest 10% of your money on the house in neighborhood

A and the remaining on the house in neighborhood B, what is the portfolio risk of your

investment?

Definitions:

Beginning Inventory

The value of a company's inventory at the start of an accounting period, before any purchases or sales have been made.

Absorption Costing

An accounting method that assigns all manufacturing costs, including both variable costs and fixed overhead, to the production units, making them more expensive on a per-unit basis.

Break-even

The financial point at which revenues exactly match costs, resulting in no net loss or gain.

Product Costs

Costs that are directly associated with the creation of a product, including material, labor, and overhead expenses.

Q1: Referring to Scenario 2-2, across all of

Q1: True or False: Referring to Scenario 8-11,

Q14: Referring to Scenario 10-3, suppose <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2675/.jpg"

Q31: You were told that the amount of

Q78: True or False: Referring to Scenario 8-9,

Q88: Referring to Scenario 4-3, the probability that

Q88: True or False: When you work with

Q138: Suppose a 95% confidence interval for μ

Q154: Referring to the histogram from Scenario 2-10,

Q195: True or False: The possible responses to