SCENARIO 5-1 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-1

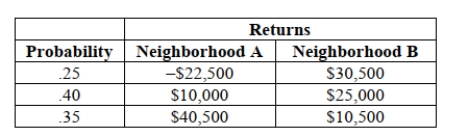

There are two houses with almost identical characteristics available for investment in two different

neighborhoods with drastically different demographic composition.The anticipated gain in value

when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-1, if your investment preference is to maximize your expected return

and not worry at all about the risk that you have to take, will you choose a portfolio that will

consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the

remaining on the house in neighborhood B?

Definitions:

World War II

A worldwide war that occurred between 1939 and 1945, engaging the majority of the world's countries, including all major powers, which eventually split into two conflicting military coalitions: the Axis and the Allies.

Exchange Rates

The value of one currency for the purpose of conversion to another, determining how much of one currency can be exchanged for another currency.

Purchasing Power Parity

A theory which states that exchange rates between currencies are in equilibrium when their purchasing power is the same in each of the two countries.

Exchange Rate

The price at which one country's currency can be exchanged for another country's currency.

Q27: True or False: In a set of

Q45: True or False: If the distribution of

Q48: Major league baseball salaries averaged $3.26 million

Q55: Referring to Scenario 9-3, the appropriate hypotheses

Q62: According to a survey of American households,

Q64: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2675/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q78: True or False: The expected return of

Q105: Referring to Scenario 9-9, which of the

Q116: Referring to Scenario 2-7, _ percent of

Q156: True or False: The sum of relative